Facts About Is Yield Farming Dead? – Finematics Revealed

The Of What is Yield Farming in Crypto? - TechSling Weblog

Prior to sending out a message to us, kindly note that we do decline ask for financing. Thank you for your understanding.

Yield farming is the practice of staking or lending crypto assets in order to generate high returns or rewards in the form of additional cryptocurrency. This ingenious yet risky and volatile application of decentralized finance (De, Fi) has increased in popularity just recently thanks to additional innovations like liquidity mining. Yield farming is presently the biggest development motorist of the still-nascent De, Fi sector, helping it to balloon from a market cap of $500 million to $10 billion in 2020.

These incentives can be a portion of deal costs, interest from lenders or a governance token (see liquidity mining below). These returns are expressed as an annual percentage yield (APY). As more investors include funds to the associated liquidity pool, the value of the provided returns rise in worth. In the beginning, most yield farmers staked well-known stablecoins USDT, DAI and USDC.

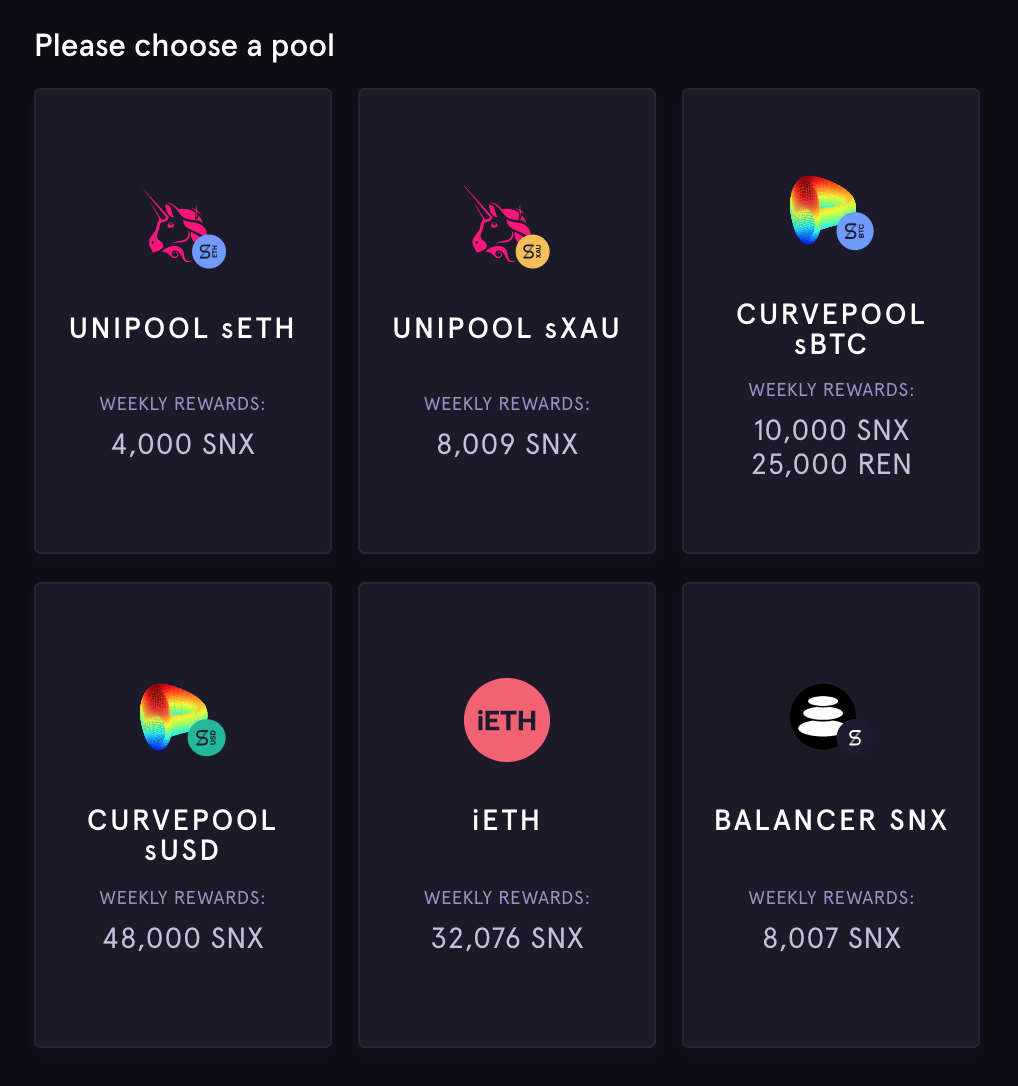

Liquidity mining takes place when a yield farming participant makes token rewards as additional settlement, and pertained to prominence after Substance began providing the skyrocketing COMPENSATION, its governance token, to its platform users. Many yield farming procedures now reward liquidity companies with governance tokens, which can normally be traded on both central exchanges like Binance and decentralized exchanges such as Uniswap.

Earn Yield Farming Rewards with DeFi Yield Protocol (DYP) – Press release Bitcoin News - USA News Lab

Top Yield Farming coins by Market Cap - CoinCodex Fundamentals Explained

These platforms provide variations of incentivized financing and borrowing from liquidity swimming pools. Here are 7 of the most popular yield farming procedures:1. Compound is a money market for loaning and obtaining properties, where algorithmically adjusted compound interest as well the governance token COMPENSATION can be earned. 2. Need More Info? , DAO is a decentralized credit leader that lets users lock crypto as collateral assets to obtain DAI, a USD-pegged stablecoin.

What Is Yield Farming in Decentralized Finance (DeFi)? - Binance Academy

Aave is a decentralized loaning and loaning protocol to develop money markets, where users can obtain properties and make substance interest for financing in the kind of the AAVE (previously LEND) token. Aave is also understood for assisting in flash loans and credit delegation, where loans can be issued to customers without collateral.